Village & Farmer CRM

Screen and onboard potential villages and farmers, capturing key info for lead generation and targeting.

Transforming Cambodia's businesses through digital solutions and financial inclusion.

Screen and onboard potential villages and farmers, capturing key info for lead generation and targeting.

Sell to farmers on flexible credit terms, track down payments and installments, and manage outstanding balances.

Assign routes, monitor activities, and evaluate performance of your field reps across all regions.

Instant invoice financing for suppliers and FIs.

Suppliers can submit invoices online for fast processing and funding eligibility.

Built-in scoring system using qualitative and quantitative data analysis.

Financial institutions can review, approve, and monitor all requests with full control over credit exposure and loan terms.

Easily monitor overdue loans, identify risky accounts early, and track follow-up actions to reduce non-payments and defaults.

Pulls data from ERP systems, field sales activities, loan repayments, and financial institution (FI) inputs to build a unified credit profile for each borrower or business.

Combines hard metrics (repayment history, transaction volumes, income consistency) with soft indicators (sales rep evaluations, village-level insights, behavioral patterns) to produce a comprehensive credit score.

Enables financial institutions to access up-to-date scores, risk indicators, and creditworthiness assessments directly from their dashboards to make faster and smarter lending decisions.

Exseed Dashboard for MFIs provides a customized dashboard which reports the overall credit worthiness of businesses that use the ERP for quick and concise monitoring and decision making.

Connect directly to ERP systems used by suppliers to retrieve financial data at the source. Exseed ensures data accuracy and freshness, reducing risk from outdated or manipulated reports.

The Exseed Dashboard is built with API-ready architecture, making it easy to push approved loan data and repayment schedules into your existing Loan Management System (LMS) or core banking platform. No double entry. No delays.

Access Exseed Credit Score™ directly from the dashboard—get breakdowns of financial ratios, cash flow trends, and behavioral metrics in an intuitive format that supports confident decision-making.

We tackle the unique challenges that small and medium-sized enterprises (SMEs) face in Southeast Asia, empowering them to thrive in the digital age.

Struggling with inefficiencies and outdated processes, SMEs face challenges in managing their operations.

Many small businesses cannot afford modern solutions or lack the digital skills to adopt them.

Traditional financial institutions are hesitant to offer loans or services to SMEs, limiting their growth potential.

Reliance on manual processes leads to delays, errors, and reduced competitiveness in the market.

Exseed ERP is a cloud-based business management platform that offers all of the standard functionalities of an ERP system at an affordable price point.

Manage your stores seamlessly in the cloud, giving your small business the tools it needs to thrive.

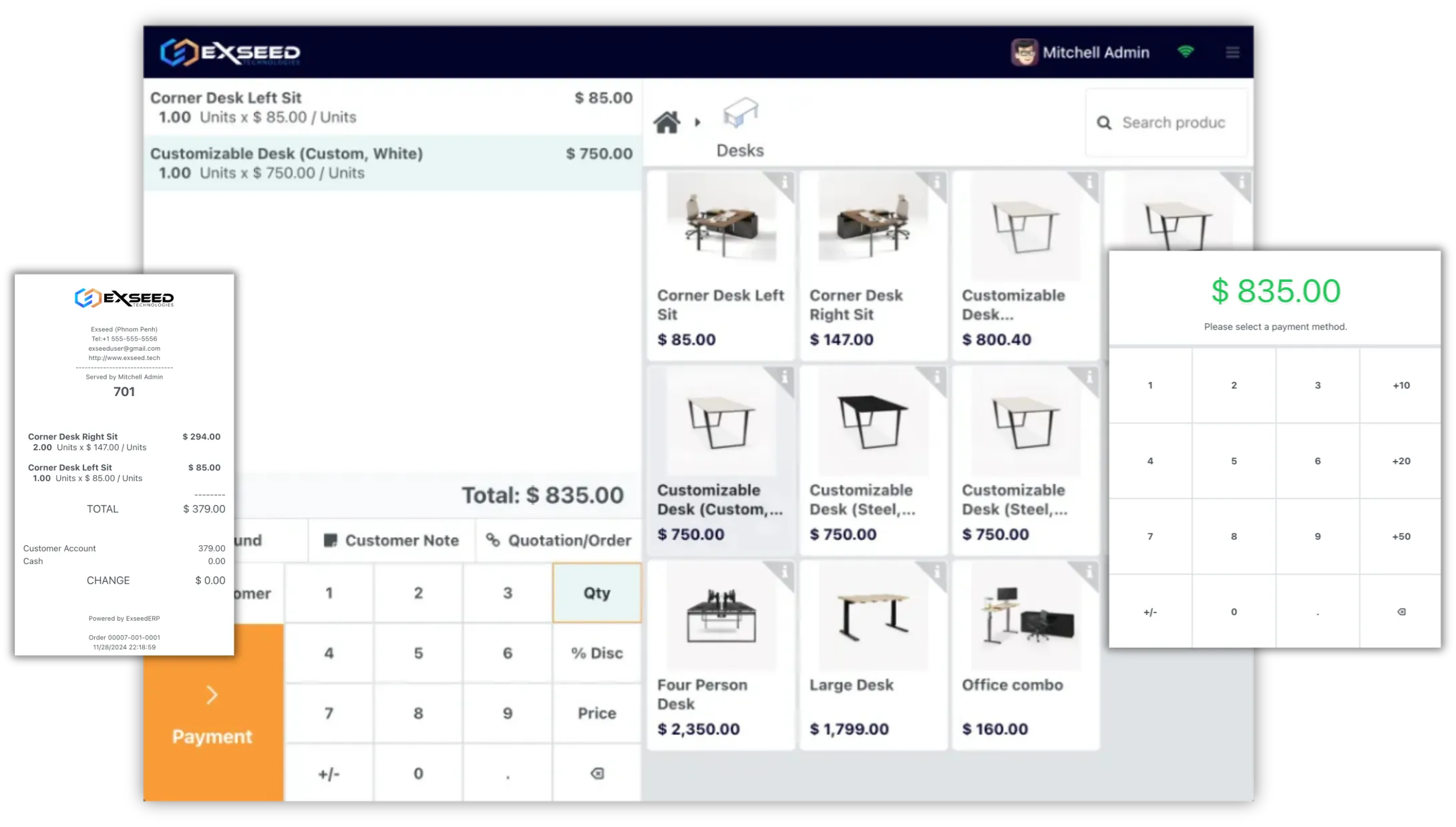

Manage shops or restaurants, sell products easily in one screen, manage sessions and invoices, be compatible with many devices fully integrated with inventory and be able to work online or offline.

Suitable for Cambodian businesses, including local tax regulations, currency support, and compliance with local business requirements.

We can be your...

Professional services that assist businesses of all sizes design, to execute their digital transformation.

Commercial software and Internet services that provide software solutions that are hosted and integrated.

Our platform is designed to cater to the unique needs of businesses across various industries, empowering them to thrive in the digital age.

Leverage our expertise and technology to unlock new revenue streams and accelerate your business growth.

Benefit from our customizable solutions that adapt to your unique business needs and requirements.

Differentiate your offerings and stay ahead of the competition with our innovative technology and services.

Enhance your customer experience and engagement through our digital channels and solutions.

© Exseed Technologies 2024, All Rights Reserved